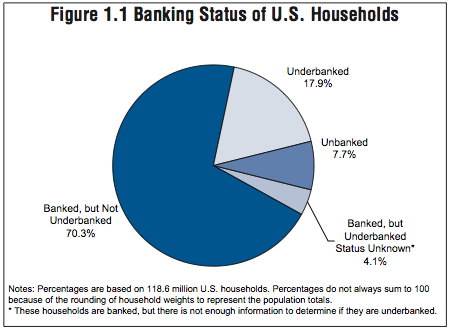

60 million Americans are unbanked or underbanked, according to a 2009 report from the FDIC. Approximately 7.7 percent of U.S. households, or 17 million adults, are unbanked, meaning they have no checking or savings account at all.

An estimated 17.9 percent of households, or 43 million adults, are underbanked, meaning they have a checking or savings account but rely on alternative financial services like non-bank money orders, non-bank check-cashing services, payday loans, rent-to-own agreements, pawn shops or refund anticipation loans.

The FDIC report shows that, the proportion of U.S. households that are unbanked varies considerably among different racial and ethnic groups, with certain racial and ethnic minorities more likely to be unbanked than the population as a whole. Minorities more likely to be unbanked include blacks (an estimated 21.7 percent of African American households are unbanked), Hispanics (19.3 percent), and American Indian/Alaskans (15.6 percent). Racial groups less likely to be unbanked are Asians (3.5 percent) and whites (3.3 percent).

Certain racial and ethnic minorities are more likely to be underbanked, as well, including African Americans (an estimated 31.6 percent), American Indian/ Alaskans (28.9 percent), and Hispanics (24.0 percent). Asians and whites are less likely to be underbanked (7.2 percent and 14.9 percent, respectively).

Certain racial and ethnic minorities are more likely to be underbanked, as well, including African Americans (an estimated 31.6 percent), American Indian/ Alaskans (28.9 percent), and Hispanics (24.0 percent). Asians and whites are less likely to be underbanked (7.2 percent and 14.9 percent, respectively).

Challenges of the Unbanked

Personally, I cannot imagine being one of the 17 million Americans who don’t have any kind of bank account, because of how it would severely limit my financial options.

If I didn’t have a bank account, I don’t think I could get a mortgage, rent a car, buy plane tickets, buy apps or songs from iTunes, buy anything else online, or do anything that required a debit or credit card.

I’d have to get a money order every time I wanted to make a payment, and pay check cashing fees whenever I needed to cash a check. I’d pay a pretty steep interest rate if I had to borrow from a payday loan place or pawn shop. And I’d definitely have to find a secure place to store my cash.

Why Many in the U.S. Do Not Have Bank Accounts

There are plenty of reasons why many in the U.S. don’t have bank accounts, including:

- Can’t afford bank fees – Ironically, people who don’t have bank accounts will probably end up paying more fees to cash their checks than they would have if they had a bank account. One reason I love credit unions is that they’re member owned and have fewer (if any) fees than regular banks.

- Bad credit history – Mistakes from their past may prevent them from opening an account.

- Don’t understand how the banking system works – They’re afraid they’ll lose their money or be taken advantage of.

- Can’t balance a check book – They’re nervous that they’ll make a mistake in reconciling their statement and may end up bouncing checks.

- Mistrust of banks – Who can blame them after the recent financial meltdown?

- No local branches – In many poorer communities (where many of the unbanked live), there are few, if any, banks to choose from.

I think the numbers of unbanked and underbanked people here in America will decrease over the coming years, as more of our economy depends on online banking or mobile banking methods. The fact that the U.S. Treasury is phasing out the printing of checks and moving toward 100% direct deposit will mean that millions of retirees and other benefit receivers will need to open bank accounts so they’ll continue to receive their benefits in a timely manner.

I said earlier that I couldn’t imagine being among the unbanked or underbanked. What about you? Have you lived without a bank account, or could you survive without one today? Please share your comments below.

You might also like: